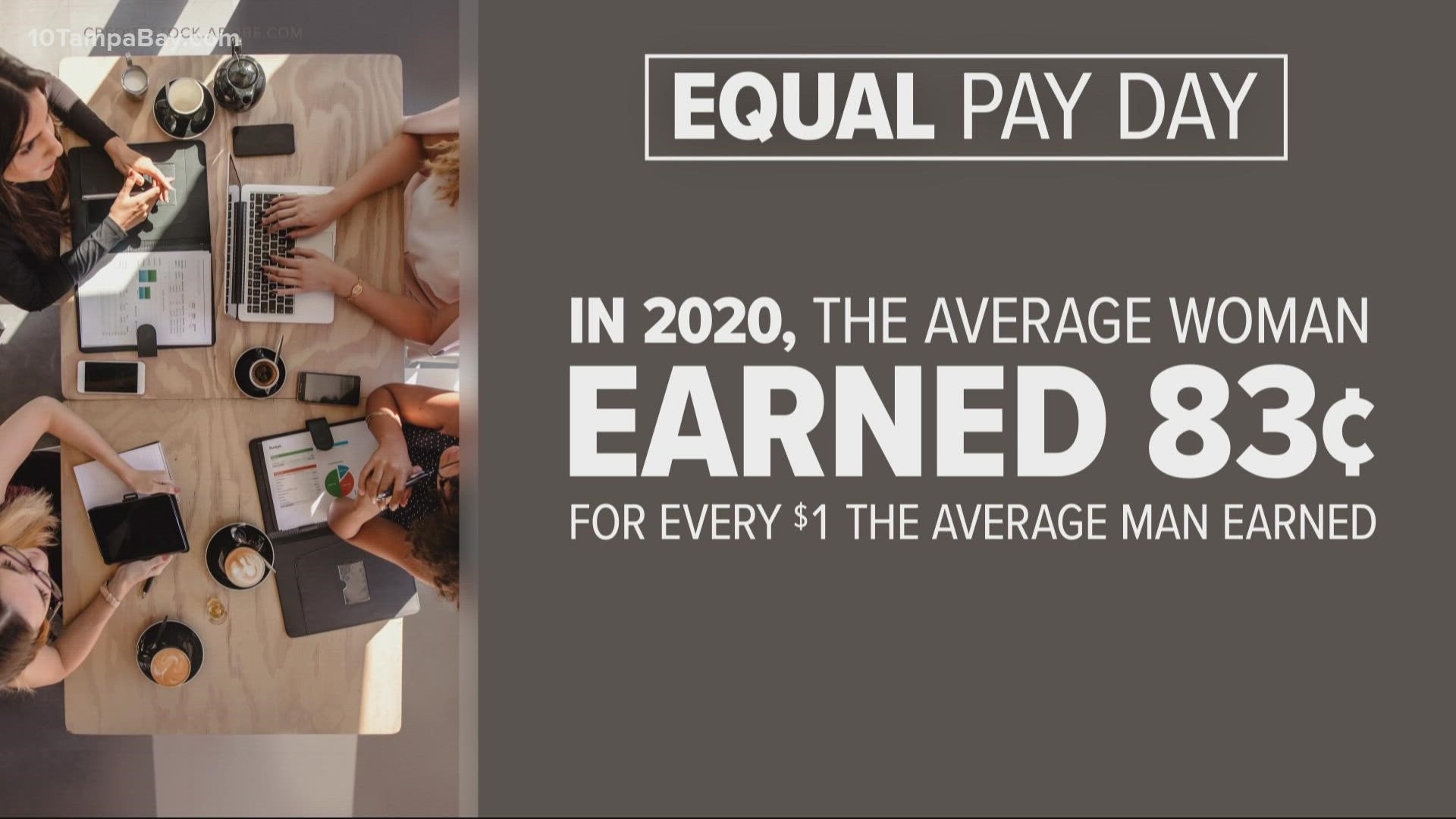

ST. PETERSBURG, Fla. — Tuesday is Equal Pay Day. It's how far into the year a woman has to work to earn the same amount of pay that a man doing the same job made last year.

In 2020, the average woman earned 83 cents for every one dollar the average man earned. While the pay gap impacts all women, there are even greater disparities for Black women, Native Americans and Latinas.

The Biden Administration is taking steps towards pay equity with these five things:

- Advancing pay equity for the Federal workforce

- Promoting efforts to achieve pay equity for job applicants and employees of Federal contractors

- Strengthening pay equity audits by Federal contractors

- Ensuring equitable access to good-paying jobs

- Addressing discrimination against caregivers

The Southeast Director for the U.S. Department of Labor Women's Bureau Charmaine Davis says underpaid women dominated in jobs like healthcare, in and outside of the home, and childcare. It's one of the biggest contributors to the pay disparities. Childcare workers make about $25,000 a year.

“You're pouring into and investing in young children, but also, if we're not compensating child care workers and providing them with family-sustaining wages, then we'll continue to see these worker shortages, and we'll continue to see that it's more and more difficult for women to return to the labor force and just other workers in general," Davis said.

“Outside of the fact their paychecks are not as big as their male counterparts typically, there’s a ripple effect because then they can’t pay off debt as much," financial advisor Katlyn Orton said. "They’re not saving as much for retirement. They’re not putting down as much for a house. And then they’re 401Ks are not being funded as much, so it does become more than just in this moment in time. It kind of becomes a life-long issue."

Financial experts say do your research when you do go to ask for the raise and know what you're worth. When you get it, diversify your investments.

“If it's a junk drawer of a financial plan that you have, let's make sure it's organized," Orton said. "Make sure that all parts are playing together right, you don't want to have all super aggressive investments or all super safe investments. You want to make sure you're looking at it holistically and make sure it all works with you and your goals and what you want to accomplish."

She says time is one of the most important factors, so if you’re no longer contributing to your savings, it’s not compounding interest. She says if you’re young, save something because time is on your side.

For help with financial literacy, click here.