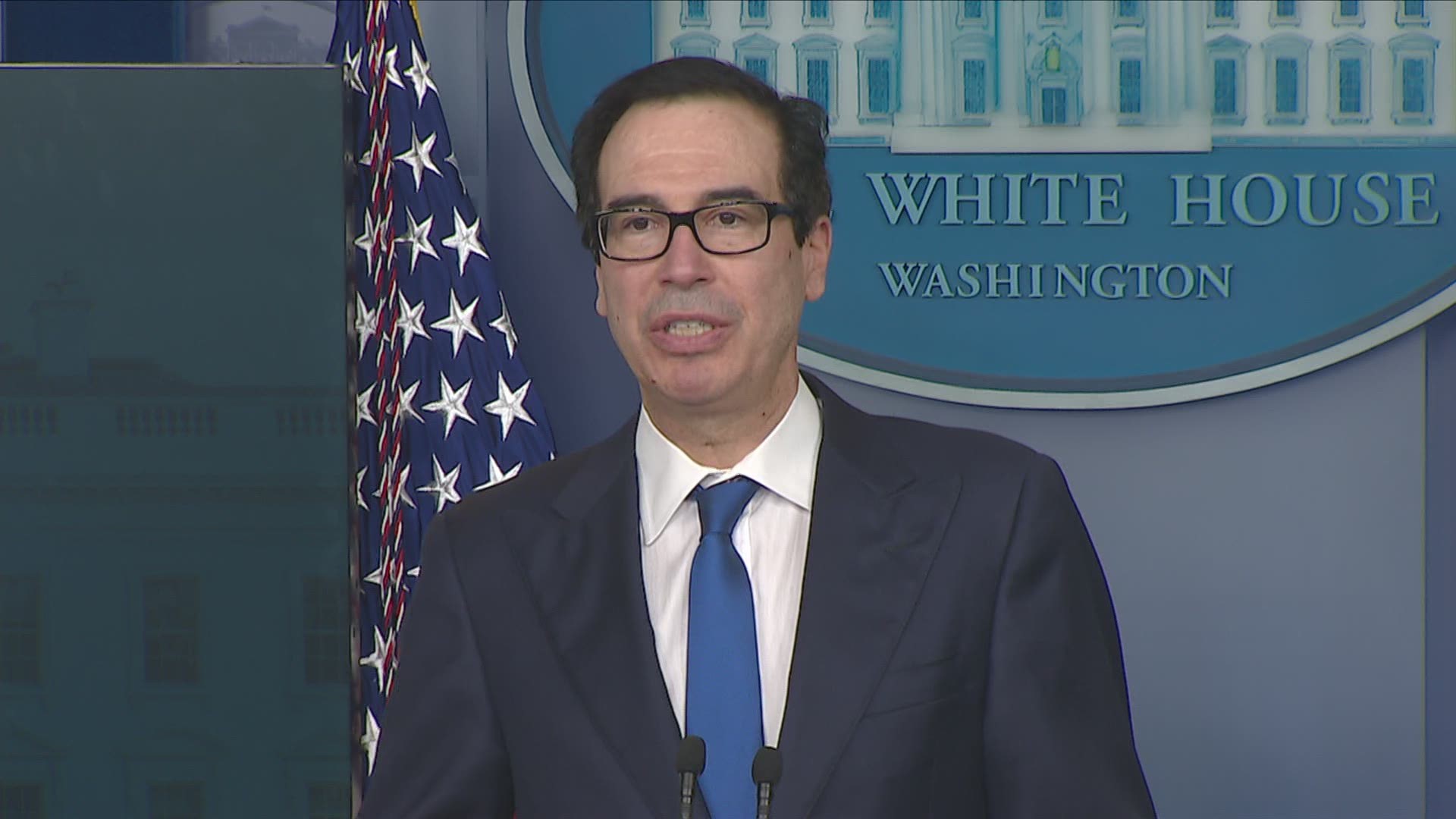

WASHINGTON — More than 80 million Americans should have their stimulus check deposited automatically into their bank accounts by Wednesday, Treasury Secretary Steven Mnuchin said on Monday.

The Treasury Department explained in a press release that those who filed 2019 or 2018 tax returns and received a refund using direct deposit should get their coronavirus stimulus payments this week.

The payments are part of the $2.2 trillion rescue package signed into law by President Donald Trump aimed at combating the economic ravages of the coronavirus outbreak.

If you don't see your money in your bank account by then, don't panic.

Starting on Wednesday, the IRS will launch a new web tool that will show when people can expect their payment. The "Get My Payment" tool will "provide people with the status of their payment, including the date their payment is scheduled to be deposited into their bank account or mailed to them."

The IRS said the "Get My Payment" tool will also let eligible individuals submit bank information, if they haven't already, so they can get their payment quicker than waiting for a paper check in the mail.

Mnuchin said those who submit their direct deposit info should have the money automatically deposited into their account in "several days."

"We want to do as much of this electronically as we can. It's very important in this day and age, it's more secure and you don't have to go to the bank," Mnuchin described on Monday. He added that they are "very pleased" the payments are going out ahead of schedule.

On Friday, the Treasury Department and the IRS also launched a new online tool that allows people who don't normally file a tax return to quickly register for their coronavirus stimulus check. The non-filer tool is specifically designed for people who don’t typically have a tax return filing obligation, including those with too little income to file. The feature is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

More Frequently Asked Questions and info from IRS.gov about the coronavirus stimulus checks and the non-filer tool:

Here is what you need to know about your Economic Impact Payment. For most taxpayers, payments are automatic, and no further action is needed. This includes taxpayers who filed tax returns in 2018 and 2019 and most seniors and retirees.

Who is eligible?

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

$75,000 for individuals

$112,500 for head of household filers and

$150,000 for married couples filing joint returns

Taxpayers will receive a reduced payment if their AGI is between:

$75,000 and $99,000 if their filing status was single or married filing separately

112,500 and $136,500 for head of household

$150,000 and $198,000 if their filing status was married filing jointly

The amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

Eligible retirees and recipients of Social Security, Railroad Retirement, disability or veterans' benefits as well as taxpayers who do not make enough money to normally have to file a tax return will receive a payment. This also includes those who have no income, as well as those whose income comes entirely from certain benefit programs, such as Supplemental Security Income benefits.

Retirees who receive either Social Security retirement or Railroad Retirement benefits will also receive payments automatically.

Who is not eligible?

Although some filers, such as high-income filers, will not qualify for an Economic Impact Payment, most will.

Taxpayers likely won't qualify for an Economic Impact Payment if any of the following apply:

Your adjusted gross income is greater than

$99,000 if your filing status was single or married filing separately

$136,500 for head of household

$198,000 if your filing status was married filing jointly

You can be claimed as a dependent on someone else’s return. For example, this would include a child, student or older dependent who can be claimed on a parent’s return.

You do not have a valid Social Security number.

You are a nonresident alien.

You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

How much is it worth?

Eligible individuals with adjusted gross income up to $75,000 for single filers, $112,500 for head of household filers and $150,000 for married filing jointly are eligible for the full $1,200 for individuals and $2,400 married filing jointly. In addition, they are eligible for an additional $500 per qualifying child.

For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$112,500/$150,000 thresholds. Single filers with income exceeding $99,000, $136,500 for head of household filers and $198,000 for joint filers with no children are not eligible and will not receive payments.

Who should use the non-filer tool?

According to the IRS, the Americans who should use the non-filer tool include:

- If you did not file a 2018 or 2019 federal income tax return because your gross income was under $12,200 ($24,400 for married couples). This includes people who had no income.

- If you weren’t required to file a 2018 or 2019 federal income tax return for other reasons

Who should NOT use this non-filer tool?

People who receive the following benefits should not use the non-filing tool:

- Social Security retirement benefits

- Social Security Disability Insurance benefits

- Railroad Retirement and Survivor Benefits

However, if you're in one of those groups and have children under the age of 17, you can use the IRS non-filer application to claim the extra $500 payment per child.

How do you use the non-filer tool?

For those who don’t normally file a tax return, the process is simple and only takes a few minutes to complete. First, visit IRS.gov, and look for “Non-Filers: Enter Payment Info Here.” Then provide basic information including Social Security number, name, address, and dependents. The IRS will use this information to confirm eligibility and calculate and send an Economic Impact Payment. Using the tool to get your payment will not result in any taxes being owed. Entering bank or financial account information will allow the IRS to deposit your payment directly in your account. Otherwise, your payment will be mailed to you.

“Non-Filers: Enter Payment Info” is secure, and the information entered will be safe. The tool is based on Free File Fillable Forms, part of the Free File Alliance’s offerings of free products on IRS.gov.