ST. PETERSBURG, Fla. — Fighting inflation is top of mind for many. The Fed raised its key interest rate by 3-quarters of a point last week. That's the highest rate hike since 1994.

That could also help cool the housing market a little since the rate on a 30-year fixed mortgage is also up around 6%. That has many home buyers looking at Adjustable-rate mortgages.

Adjustable-rate mortgages or ARMs have surged to a 14-year high. Right now, they make up about 11% of all home loans, compared to just 3% at the beginning of this year. Part of the reason for that demand is people still want to buy a home but don't want to pay the higher fixed rate.

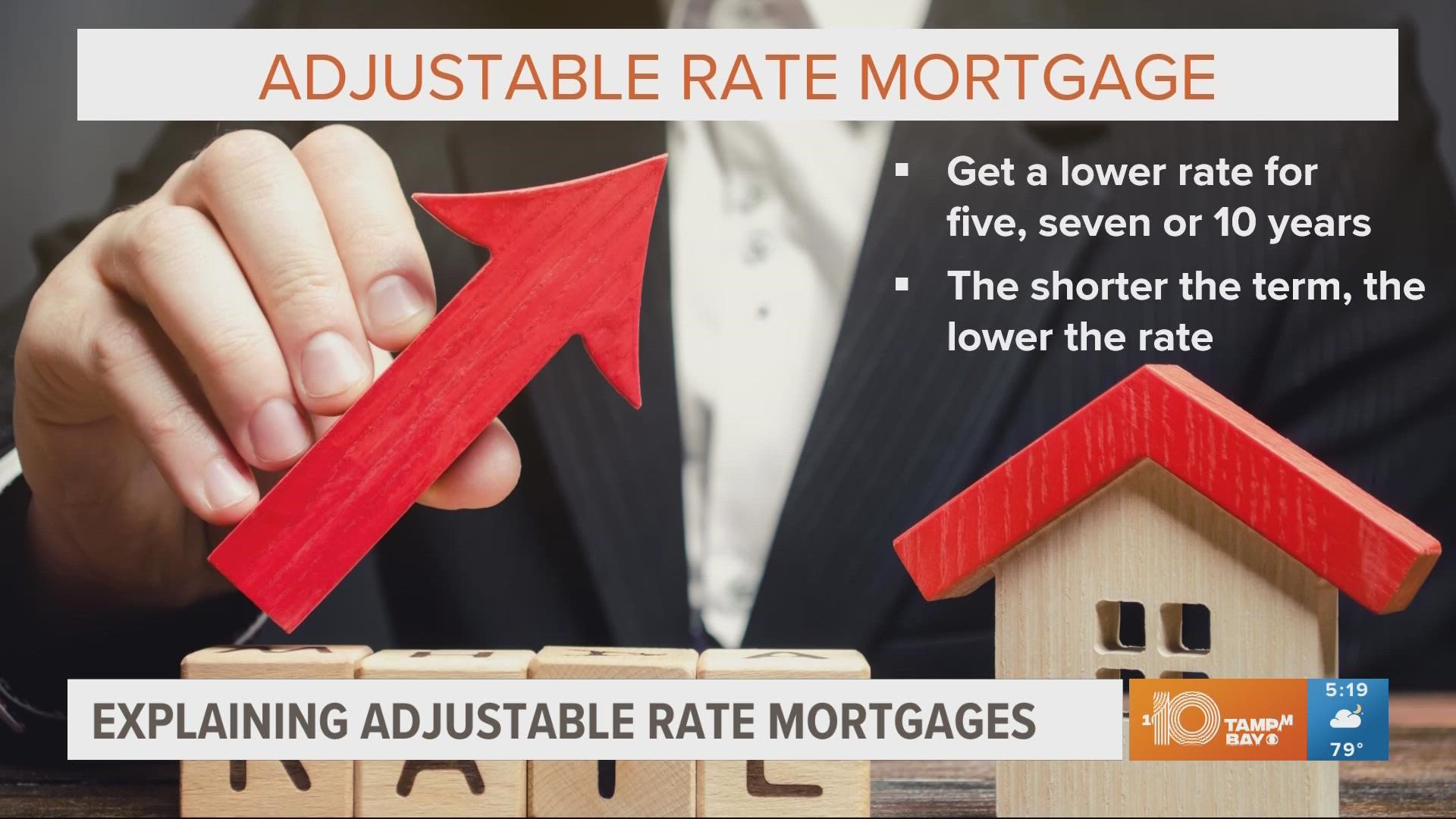

Basically, an ARM is a fully underwritten mortgage where you get a lower fixed rate for a term of five, seven, or 10 years. The shorter the term, the lower the rate. But after that five, seven, or 10 years, the rate goes up — and there's no guarantee how high.

Mike Mulwani is a Senior Vice President at Bayfirst Financial in St. Petersburg: "The risk with an ARM is that you go through the adjustment period. So let's say you take a 5-year ARM and then rates adjust, and if they adjust upward, now you're dealing with a higher payment," Mulwani said.

So you really have to know your financial situation before choosing this mortgage option. For instance, if you know you're buying a starter home and will likely sell it within that shorter term to move on to your next home. Or if you know you have money aside to pay it off before that short-term ends. A mortgage lender that knows your local market can help you decide what's best for you.