TAMPA, Fla. — To rent or to buy? That is the question for thousands of young Americans moving to big cities in 2024.

In general, it’s cheaper to rent than to buy in all major U.S. cities right now, according to a report from Bankrate that analyzed data through February 2024. This is mostly due to rent increases softening over the past year while home prices remain high and mortgage rates keep rising. It's still slim pickings when it comes to the housing inventory, too.

But before all you aspiring homeowners get discouraged, know that these factors vary depending on which city you're in.

In some metropolitan areas, there's a big gap between the monthly cost of renting and buying.

For example, the report says the typical monthly rent in the San Francisco-Oakland-Berkeley area is $3,024 compared to the typical monthly mortgage payment of $8,486.

But in other cities, the gap is much, much smaller.

In the Detroit-Warren-Dearborn area, the typical monthly rent is $1,395 compared to the typical monthly mortgage payment of $1,423 — only 2% more.

So, where does the Tampa-St. Petersburg-Clearwater metropolitan area fall?

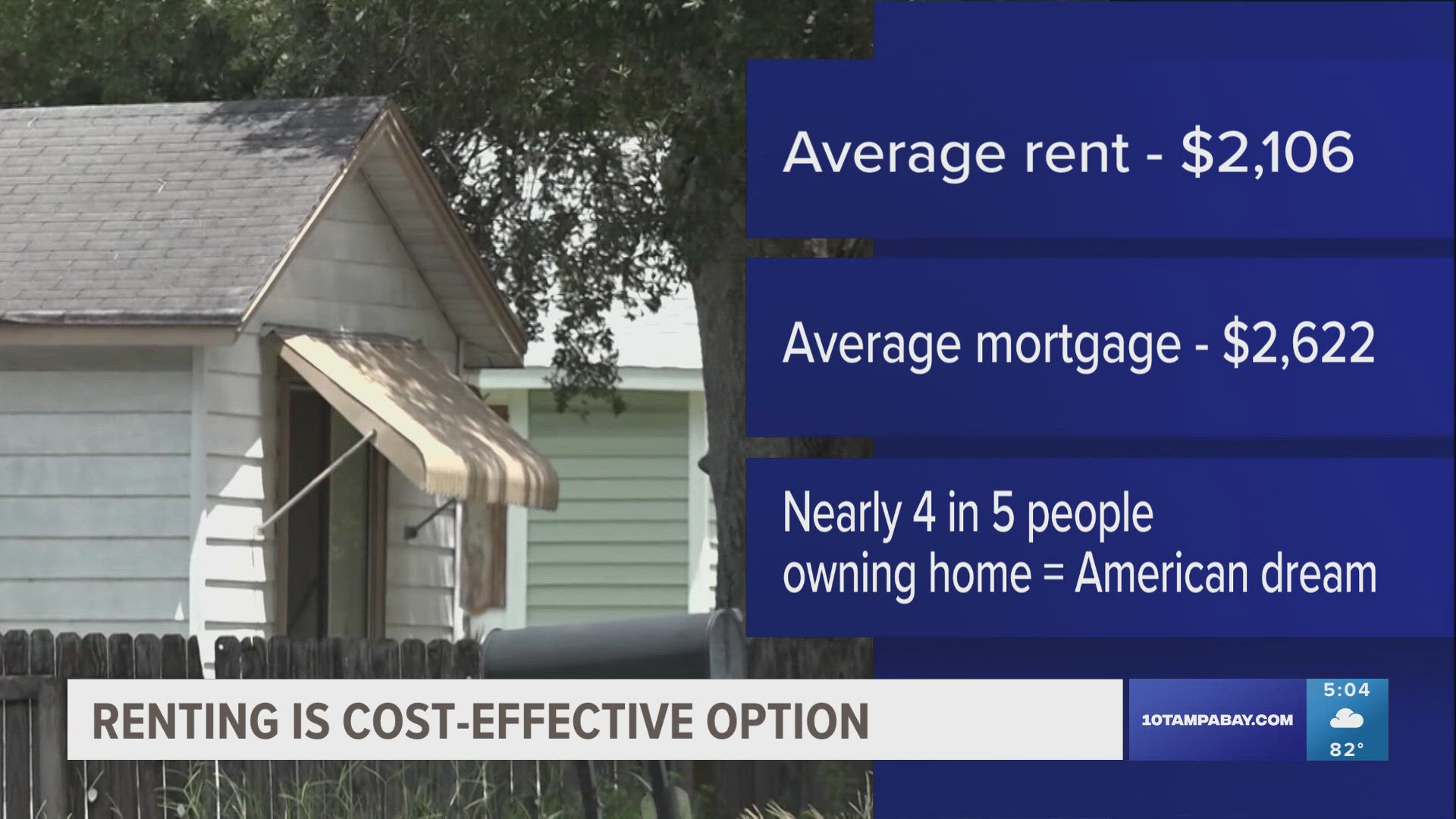

According to Bankrate, the typical monthly rent in our area is $2,106 while the typical monthly mortgage payment is $2,622.

It's also important to note that housing is rather expensive right now regardless of whether you're a renter or homeowner.

Researchers say rents surged in 2021 and 2022 as COVID-19 restrictions eased and people moved back to big cities — specifically those in Florida and other Sun Belt states.

“The long-term trend is that people seem to like the Sun Belt, probably because it’s sunny down there,” Daryl Fairweather, chief economist of Redfin, told Bankrate. “Those places have become more expensive since the pandemic because of how many people are moving in there.”

And, of course, there are pros to owning a home even if it may cost more money in the short term.

"Renting allows for more flexibility and has lower upfront costs," Bankrate researchers said. "Real estate is an asset that typically builds value over time and can later be sold for a profit, but it also typically improves your quality of life."

Economists say when you're deciding whether to rent or buy, it's important to consider these three factors:

- How much cash you have right now: Fairweather says don't be afraid to take advantage of stable rent prices and save for a year until you have more money to put toward a down payment.

- How long you see yourself living there: Danielle Hale, Realtor.com chief economist, says you're probably going to want to stay in your home for 5-7 years for buying to make sense.

- How you're building long-term wealth: Skylar Olsen, Zillow chief economist, says if you don't invest money elsewhere, a purchased home is an appreciating asset that could grow your money in the long run.