ST. PETERSBURG, Fla. — Homeowners and potential buyers, you'll want to read this through.

Flood insurance rates could change drastically in the coming days and months. It's all because of an update to the National Flood Insurance Program: FEMA Risk Rating 2.0.

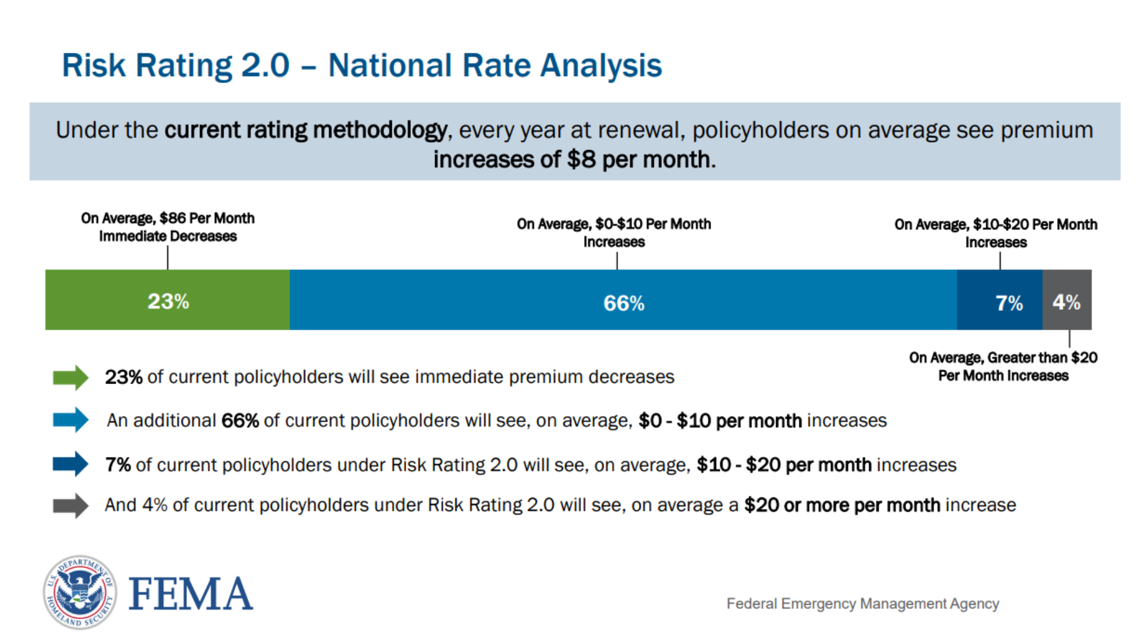

On FEMA's website, it shows most Americans - 89 percent to be exact - won't see an increase of more than $10/month on their premiums. Some, it says, could even see an immediate decrease of $86/month.

For many that are building a new home in a flood zone, you decide on spending extra to better protect your home and save on insurance. Options like building at a higher elevation and flood vents.

Chris Dailey is currently building in Shore Acres. He bought the land 5 years ago, not anticipating a change in flood insurance premium policy.

"We've been very compliant in building our houses above the flood plain," said Dailey. "We did that with the expectation that we'd see the same low premiums for being out of the flood plain."

Dailey got an insurance quote in March of 2021. His paperwork shows it was for $522 a year. Now, under Risk Rating 2.0, it's $4,986.

"Well now, this FEMA Risk Rating 2.0 takes the incentive away from us and our houses - even if you're building above the flood plain - would be rated as if it was an at-grade house," said Dailey.

FEMA previously based premium costs on flood maps and home elevation levels. Now, under the new program, it will focus on the cost of rebuild and distance to coastal flood sources.

While its website claims this is good news for most Americans, in Tampa Bay, for insurers running the numbers daily, the stats don't line up.

Brian Ford works at Insurances Resources. He said this won't just impact people in flood zones, but the real estate market as a whole.

"A lot of these people built their houses in compliance to what FEMA had asked them to," said Ford. "And now they're going to see 18 percent increases annually until they get to the Risk Rate 2.0 actuarial rate."

The new program and rates were released at the end of August. For those getting a new policy, the program goes into effect on Oct. 1. For policy renewal, the program is implemented on Apr. 1.

"The problem is most people are not going to get this information until after their renewal on Apr. 1 or later," said Ford.

For Chris Dailey, who is currently deciding if he can now afford the insurance for the home he is building, said this new program isn't helping homeowners.

"I don't know. We're still talking about our project. Is it still worth it to finish the project? I'm not sure. I found out about this a couple of weeks ago," said Dailey. "FEMA only released the rates a couple of weeks ago.

Dailey recommends you call your home and flood insurance companies right away to see how much the new program will impact your rates.

U.S. Senator Marco Rubio is currently introducing legislation to delay hikes in flood insurance premiums.