ST. PETERSBURG, Fla. — Relief is on the way for millions of Americans with federal student loans.

President Joe Biden pledged to wipe away at least $10,000 of college debt for people making less than $125,000 annually. For Pell Grant recipients, up to $20,000 will be canceled.

The move could cost $300 billion, according to CBS News.

Furthermore, loan payments will be put on hold one final time, but are set to resume in January.

President Biden unveiled the plan on Wednesday, saying in part, "95% of the borrowers can benefit from these actions. That's 43 million people. Of the 43 million, over 60% are Pell Grant recipients. That's 27 million people who will get $20,000 in debt relief. Nearly 45% can have their student debt fully canceled. That's 20 million people who can start getting on with their lives. All this means people can start finally crawl out from under that mountain of debt."

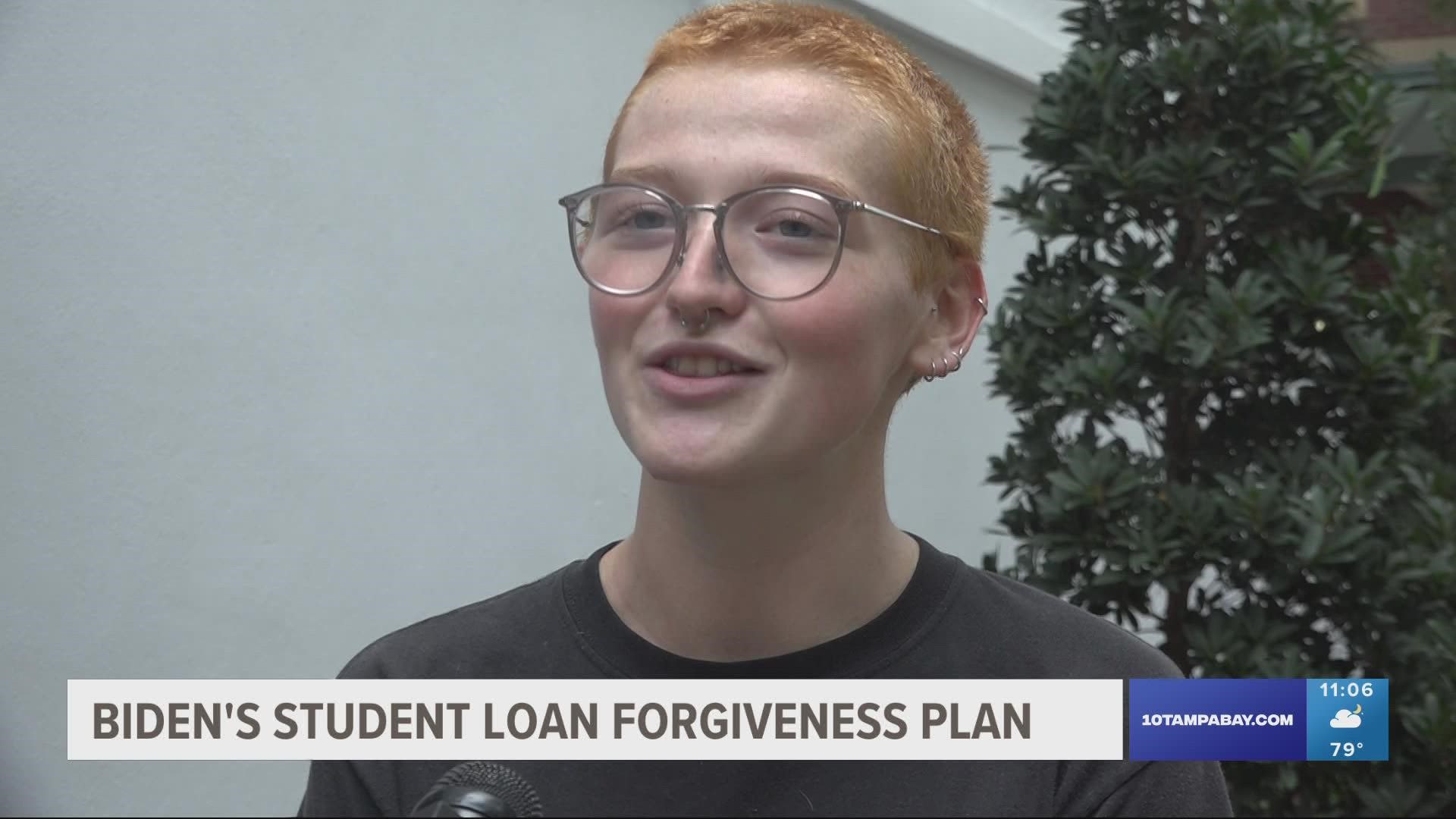

Some students at the University of South Florida in St. Petersburg told 10 Tampa Bay that they are thrilled by this announcement, but others say they're unsure of a plan that only impacts some students is what's best for all.

"This is taking off like two semesters of college for me, like a year of college, and that's incredible. Like, it's so exciting to hear," USF Junior Olivia Smith said.

Smith said having $10,000 less in student loans could change her life.

"It could change it tremendously because, believe it or not, I actually thought about transferring back home because of financial reasons, and this could be one of the leading reasons that I stay and finish my degree here in St. Pete," Smith said.

However, the matter of fairness weighs differently on other students.

USF Senior Cristian Rivera chose a local school for the in-state tuition and said he worked hard for scholarships so that he could graduate without debt.

"For those that are in difficult situations and stuff like that, I think it's good," Rivera said. "But at the same time, there are people that already paid their student loans and it's a bummer. Why do they get the chance when I didn't get notified ahead of time?"

Victor Claar is an Associate Professor of Economics at Florida Gulf Coast University, who also sees a conversation about equity emerging from this plan.

"I can see a lot of people, especially recent graduates who recently retired their loan debt, who were going to say, 'Hey, wait a minute, I just made the last payment on my loan. Where's my $10,000?'" Claar said.

Beyond triggering discussions of equity, Claar said the plan will almost certainly increase the national debt.

"In my experience, government rarely reduces spending when it increases other spending," he said.

However, with the rising cost of higher education and inflation, students like Olivia Smith argued this is a necessary move to keep the country moving forward.

"I truly do feel bad for people who've already paid off their debt," she said. "But at the end of the day, with inflation going so crazy and prices going so crazy, it's not what it used to be. College doesn't cost what it used to be. It's an astronomically high number, and this is to help this generation, which is the future of this country. So we have to put funding into us to keep this country living and growing."

Under Biden's plan, leaders with the Department of Education are also proposing that income-driven payment plans be capped at five percent of monthly income.

They're also discussing overhauling the public service loan forgiveness program.