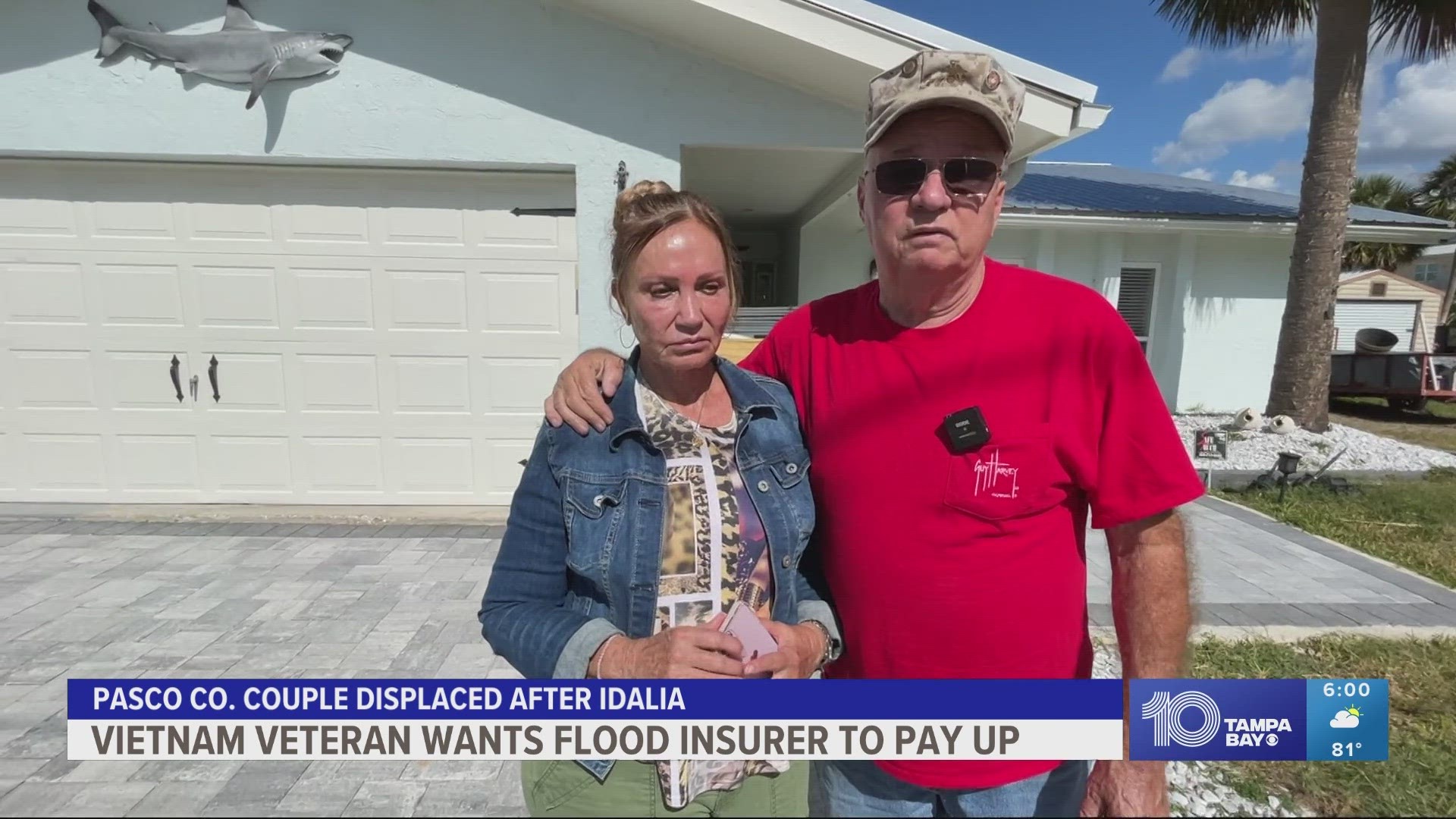

HUDSON, Fla. — John Gregory’s Pasco County home is a shell of what it was in late August when he and his wife Rosemarie evacuated as Hurricane Idalia came barreling down.

“We couldn't get back in here until two days later,” the retired U.S. Marine and Vietnam Veteran recalled.

More than two months later, the waterline is still on his outside walls, showing how high the storm surge was when more than a foot of it went inside.

“Basically, everything three foot down, including the floor had to be replaced, not to mention our furniture, refrigerator, stove,” Gregory added.

The damage?

“Probably a little over $100,000 because, I mean, we had to tear out all the drywall in the whole entire house,” Gregory added.

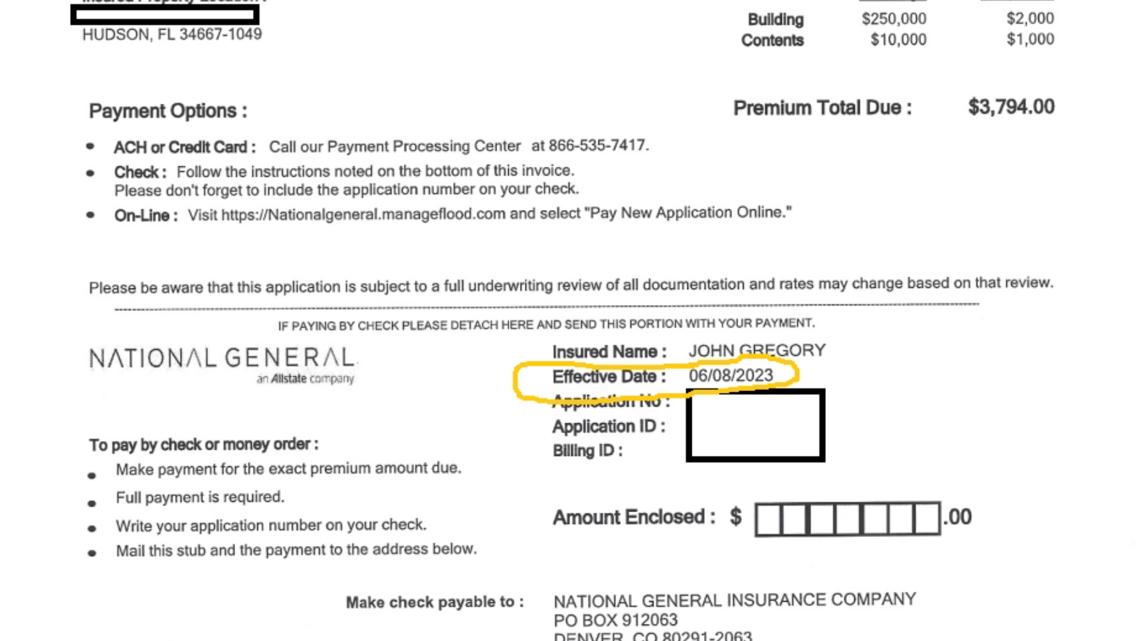

That’s why you have flood insurance, right? Well, when Gregory tried to make a claim, he says his insurer, National General, told him he wasn’t covered.

“They were paid, they took it out every month like they like they were supposed to, and we still don't have insurance, according to them,” said Gregory, who added his mortgage was transferred to another lender earlier this year and that he’s always had flood insurance paid through his escrow.

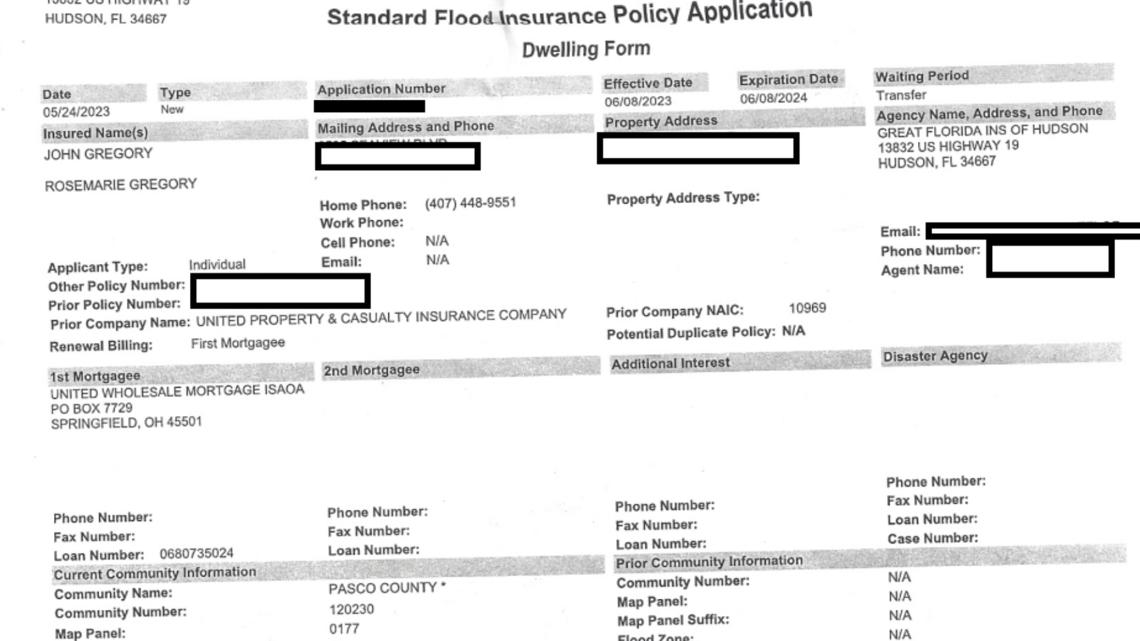

Gregory says he thought he was covered from June 2023 through June 2024. He thought, “Everything was good, which is the same thing my mortgage companies telling us.”

But it turns out things are complicated.

He filed a complaint with the state in the Office of Financial Regulation to review his lender. Carrington says the original lender received a policy from National General on June 9 and sent the application, but it was not validated.

When Carrington took over the Mortgage, they claimed they got a new application invoice for the policy term of June 2023 to June 2024.

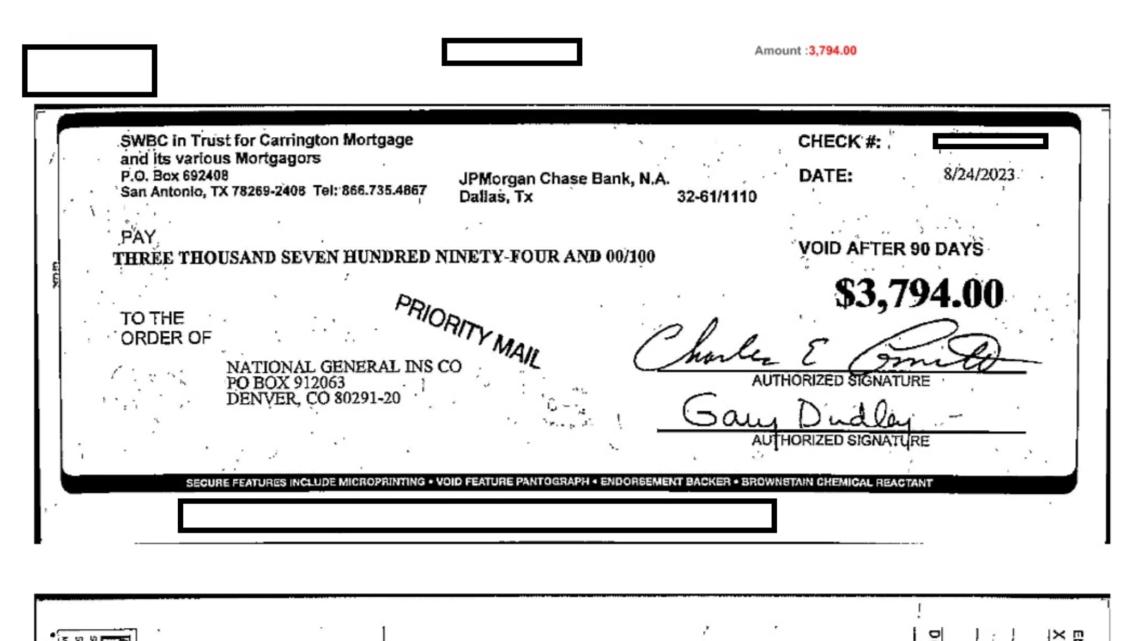

In their response, a representative from Carrington says they called National General several times over a few days to verify the policy was active and/or if more payment was due. On Aug. 23, the insurer responded requesting an overnight premium payment of more than $3700, the amount listed on the application.

Their records show the check they sent was cashed on Aug. 28, Idalia flooded the area two days later.

“They've got a copy of where they received, where they cashed it and they're still saying that we're not covered,” Gregory said.

10 Tampa Bay contacted National General Insurance to determine why they have not yet responded to our request for comment.

According to the state, many flood policies take 30 days to go into effect after purchase. Still, John says: “The insurance company sent [my mortgage lender] a letter and an email stating that we had coverage from June 23, to June 24.”

In the meantime, John and Rosemarie got a little help from FEMA, but are now approaching three months without being able to stay at their home and they’re hoping this issue gets resolved as money stretches thin.

“I expect them to take care of whatever the damage is, because that's what you buy the insurance for,” Gregory added. “I'm 100% disabled from Marine Corps, so I don't have a lot of money.”

The Gregorys say they plan on filing a complaint with the state Office of Insurance Regulation, which has resources for folks dealing with claim issues. You can check out the state's Insurer Consumer Advocate here.

We’ll keep you posted when he hears back from the insurer.