ST. PETERSBURG, Fla. — When election day rolls around this November, Florida voters will be electing a governor, a U.S. senator and several state and local officials.

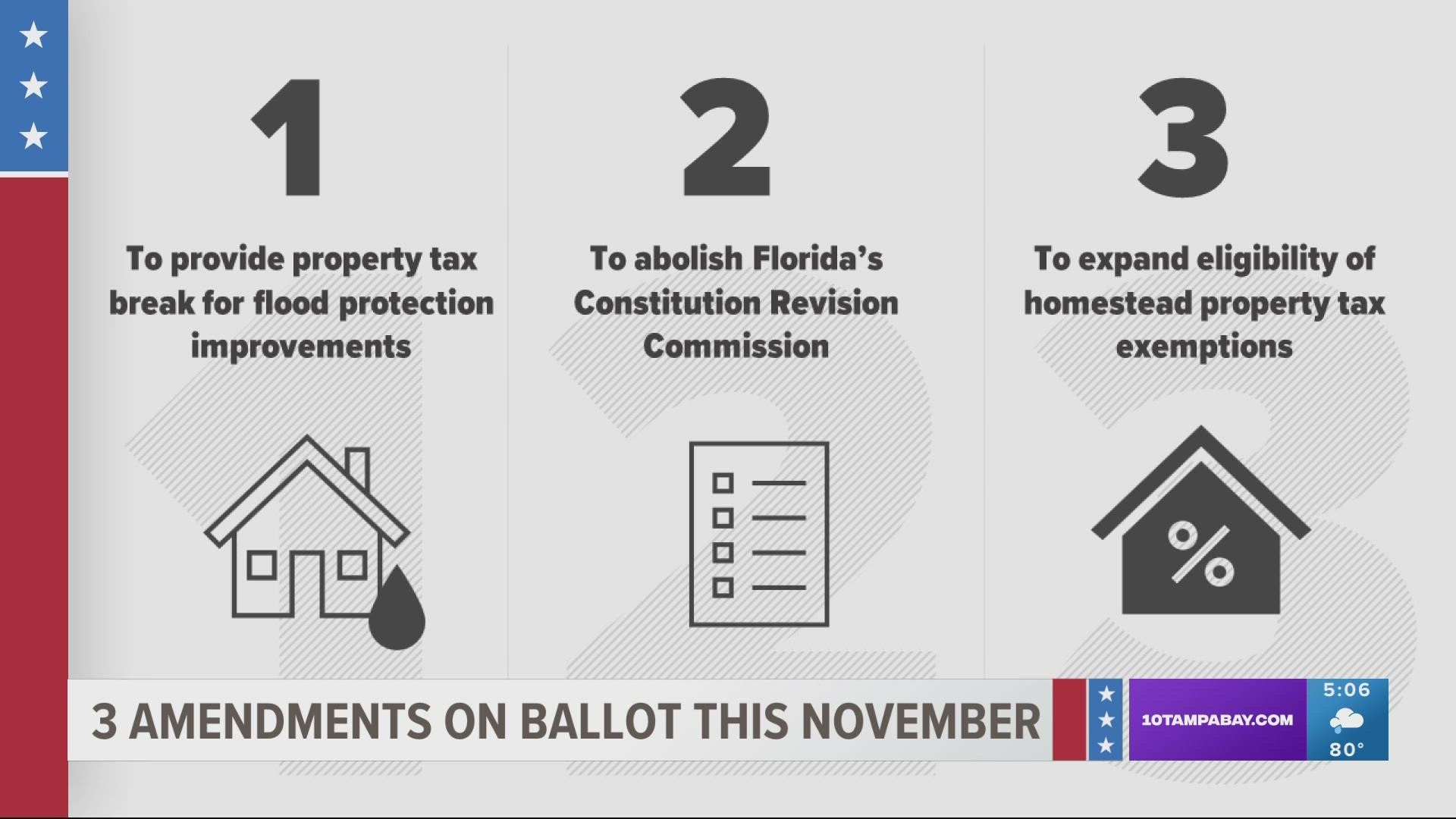

But there are also three statewide measures to consider. They're all constitutional amendments that were placed on the ballot by the Florida Legislature during the 2021 and 2022 legislative sessions.

One involves something called the Florida Constitution Revision Commission and the other two relates to property taxes.

There’s a lot to consider ahead of the Nov. 8 election, so if you’re not familiar with the three amendments, don’t worry — we broke them down for you.

Amendment 1 (the first property tax measure)

This amendment would give state lawmakers the power to stop flood-resistance home improvements from being factored into a home’s property value for tax purposes.

The Florida legislature already can exempt changes to improve the property's resistance to wind damage or the installation of a solar or renewable energy device.

"An area’s resistance to flood damage can be increased through... improvements made to individual properties, such as elevating structures, filling basements, and waterproofing," reads an analysis from the Flordia House. "Mitigation can also include non-structural improvements, such as the maintenance of and to allow for stormwater runoff, waterproofing basements, installing check valves capable of preventing water backup, and elevating furnaces, heaters, and electrical panels."

Rep. Linda Chaney, R-St. Pete Beach, who proposed the amendment, said it’s meant to incentivize homeowners to protect their property and reward them by not taxing them on the added value to their property.

“The intention of this bill is to make our communities more resilient to flooding,” said Chaney during initial discussions of the proposal in March. “It’s an opportunity for whoever is able to raise their property and get it out of harm’s way from storms and flooding.”

If approved by at least 60% of voters, the constitutional amendment will take effect on Jan. 1, 2023.

Amendment 2 (the measure to abolish the Constitution Revision Commission)

Created in 1968, the Florida Constitution Revision Commission is a group of 37 commissioners who meet every 20 years to look at how relevant our state constitution is to our current and future needs.

The group is made up of people appointed by the governor, senate president, speaker, chief justice and attorney general. Separate from the three traditional branches of government, this unique group can approve proposals from the public and place them directly on the general election ballot.

The commission came under fire in 2018 for accusations that the group bundled ballot proposals, tying unrelated topics together and leading to voter confusion.

As WUSF reports, Sen. Jeff Brandes, the St. Petersburg Republican who sponsored this amendment, said last year that the members of the commission lacked accountability.

On the other hand, the media outlet adds, St. Petersburg Democrat Sen. Darryl Rouson has argued that eliminating the commission “will make it harder for citizen voices to be heard in shaping the future of their state.”

If approved by at least 60% of voters, this amendment would abolish the Constitution Revision Commission effective Jan. 3, 2023.

Amendment 3 (the second property tax measure)

This amendment would allow state lawmakers to grant additional homestead property tax exemptions to teachers, law enforcement officers, firefighters, emergency medical technicians, paramedics, child welfare services professionals, active duty military members and Florida National Guard members.

The homestead exemption essentially reduces the taxable value of a property.

As it stands, homeowners can qualify for homestead exemptions on the first $25,000 of the appraised value of their property. An additional $25,000 tax exemption is applied on property values between $50,000 and $75,000.

If this amendment passes, homeowners in the professions listed above could receive an additional $50,000 tax exemption on property values between $100,000 and $150,000.

If approved by at least 60% of voters, this amendment would take effect on Jan. 1, 2023.