Florida lawmakers are starting to put together some bills to look at next week for the special session on property insurance.

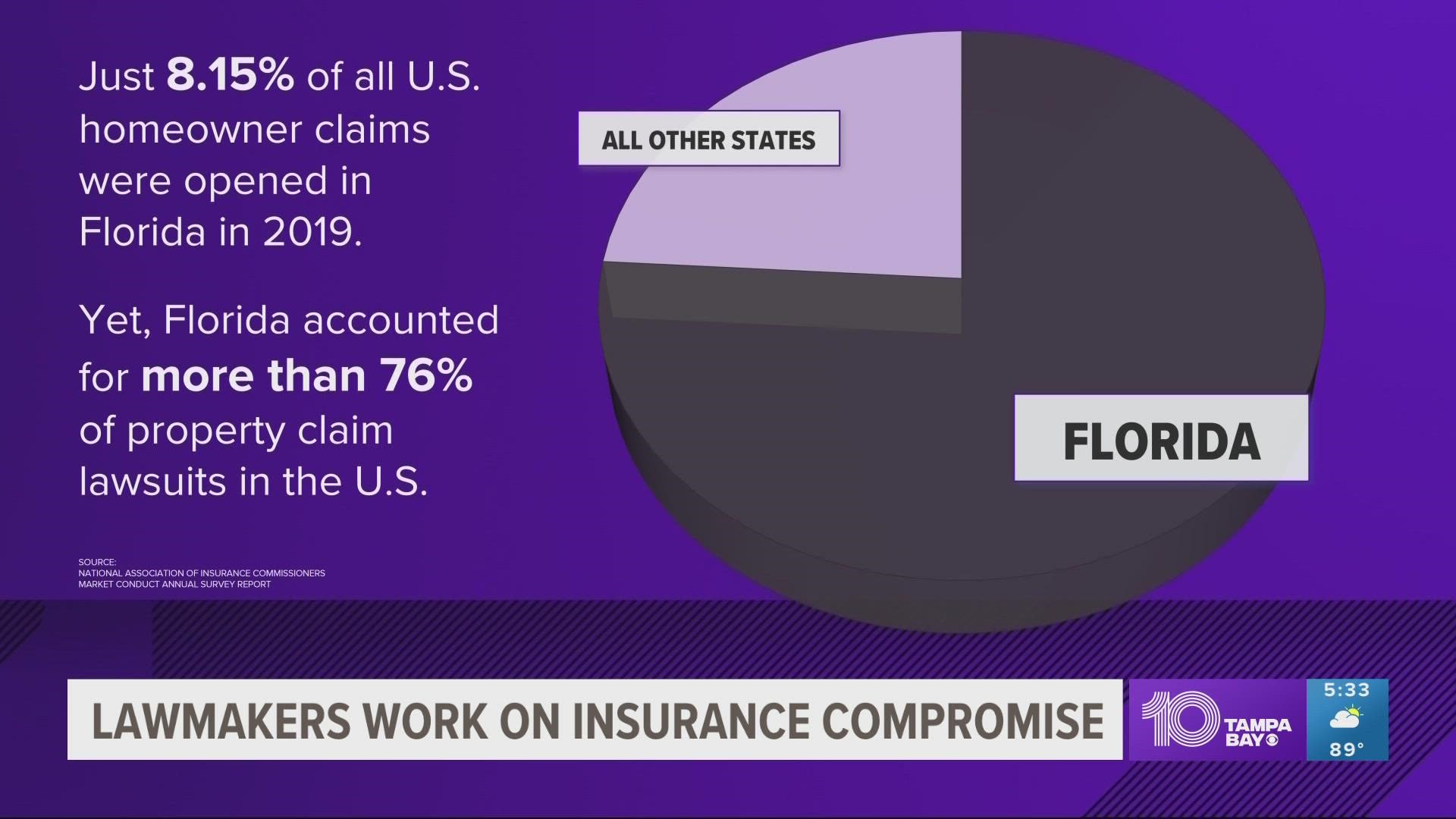

Many homeowners have seen premium increases ranging from 30 to 60 percent. One of the things that's been driving up costs is the amount of litigation. Florida accounts for 8 percent of all the property insurance claims, and 76 percent of all the lawsuits in the U.S. That's forced several insurers to go out of business this year and shrinks the amount of competition.

Sen. Jim Boyd from Bradenton is an insurance broker, so he sees the problem firsthand.

“We have to provide a market I believe that is a fair playing field. Now, when 71 percent of claims are being paid with those fees going to attorneys and 8 or 10 percent of those claim dollars are going to homeowners, there’s something wrong with that picture,” Boyd said.

He's been talking with the governor's office and collaborating with the House about a bill to address the lawsuits.

“We've got to get our arms around this litigation that's occurring that isn't appropriate that isn't proper and isn't productive and show other homeowner’s companies and carriers that Florida is an attractive place to deploy their capital,” Boyd said.

He adds his goal is to get some of the national insurers like State Farm, Allstate, and Travelers to do business here and create more competition.

One idea that's been talked about is making changes to the Florida Hurricane Catastrophe Fund. If insurers pay less, that could in turn mean lower premiums for homeowners, but it could also mean there's less money available to cover costs.

Boyd says he wants to look at changes to the CAT fund later in the year and work on the litigation issues now. He also wants to take a look at Citizens Property Insurance next legislative session, which is the state’s insurer that provides insurance to those who are unable to get policies in the private market. In 2021, the number of policies grew nearly 38 percent. Citizens is expected to have more than a million policies by the end of 2022.

“Citizens, I’ve always said, should be the market of last resort, not the market of choice,” Boyd said.

Lawmakers need to act quickly to make some compromises because that special session starts on Monday.