ST. PETERSBURG, Fla. — Just days after more than 100,000 people were affected by Farmers Insurance pulling out of Florida, another major insurer is leaving some homeowners scrambling.

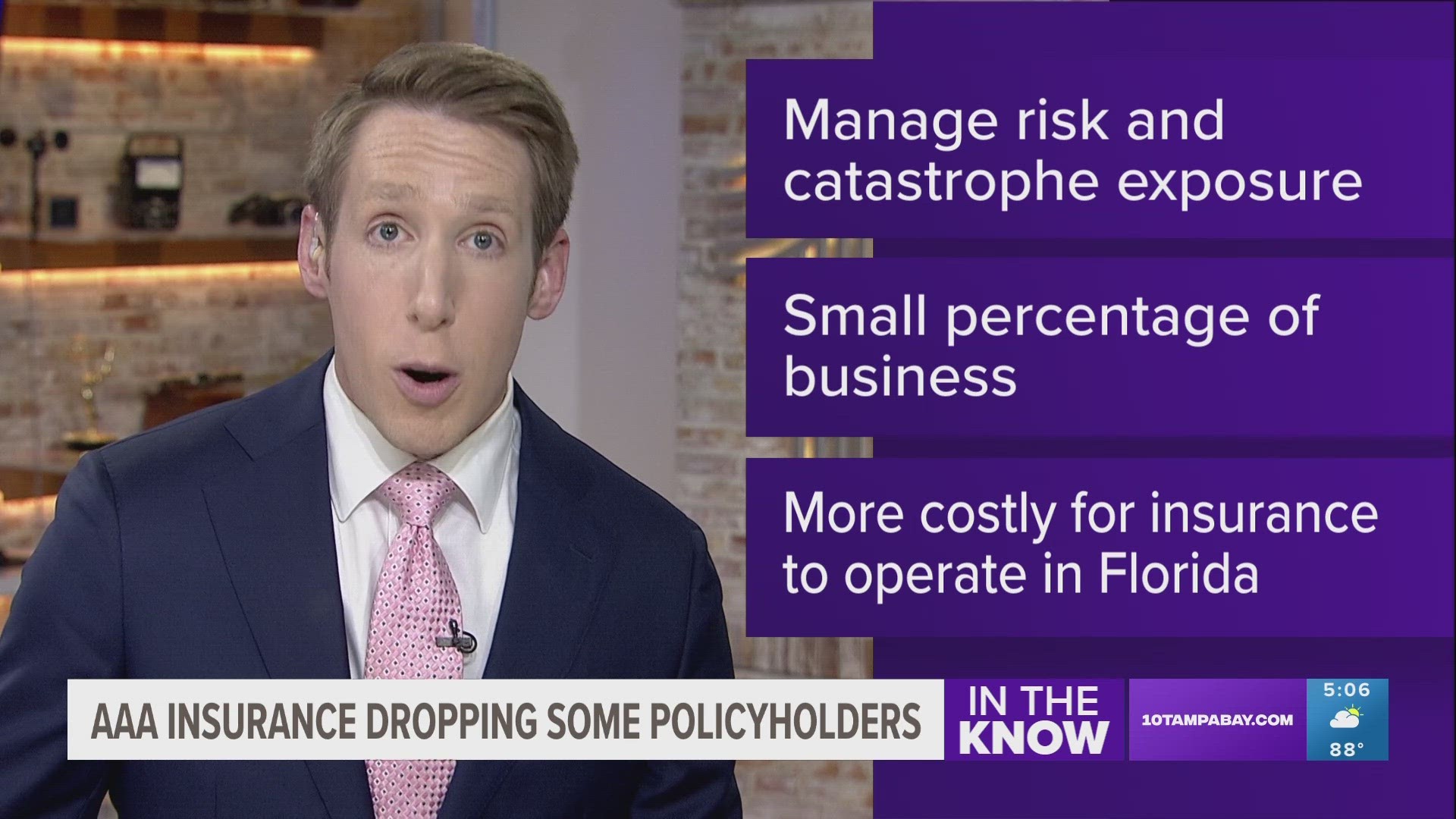

AAA Insurance confirmed on Thursday that it is dropping some policyholders in Florida "to manage risk and catastrophe exposure" — the same reason Farmers cited for its exit. AAA said these "non-renewals" account for a "small percentage" of its business but did not say how many people would lose coverage.

"This decision is one we do not take lightly, yet it’s a necessary one to reaffirm our commitment to the state and those we insure. We acknowledge that this is a difficult time for those affected. AAA insurance agents are willing and able to help them find alternate coverage," the company wrote, in part.

In a statement, a AAA spokesperson explained that last year's hurricane season, paired with rising costs from inflation and "excessive litigation" have made it more costly for all insurance companies to operate in Florida.

"We are encouraged by the statutory changes that have recently taken effect and believe they will provide positive results. Those improvements will take some time to fully materialize and until they do, AAA, like all other providers in the state, are forced to make tough decisions to manage risk and catastrophe exposure," the statement continued.

Unlike Farmers, which is backing out of Florida altogether, AAA said its "providers continue writing new home and auto insurance for our members in Florida."

The moves by AAA and Farmers are part of a larger insurance crisis that continues to plague Florida. The state's Office of Insurance Regulation (OIR) has about 18 other insurance companies on a watchlist right now.

Due to state law, consumers have to be notified by their insurers 120 days prior to their non-renewal. So, what steps should Floridians take if their coverage gets dropped?

We spoke with Kathy Walsh, agency owner at Coast to Coast Insurance in Tampa, who said the first step is to call your insurance agent to see if they offer other options.