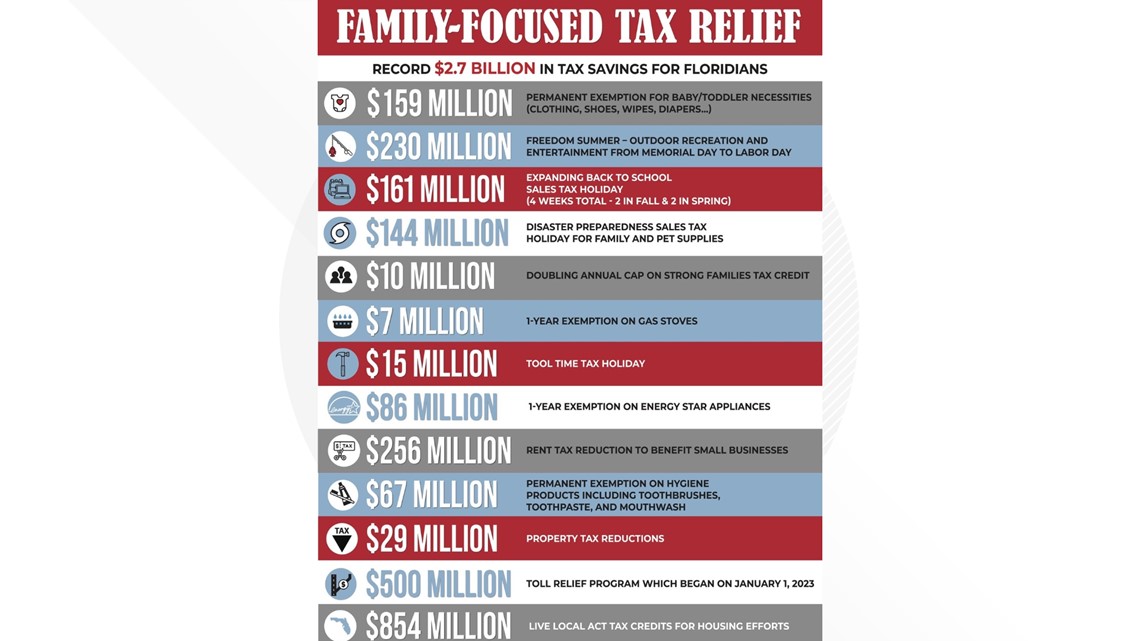

TALLAHASSEE, Fla. — Florida Gov. Ron DeSantis signed what he called the largest tax relief plan in the Sunshine State's history on Thursday, providing families with $2.7 billion in tax relief during the 2023–24 fiscal year.

A news release from DeSantis' office explains the newly signed plan includes a $159 million permanent exemption for baby and toddler necessities such as strollers, cribs, diapers and baby wipes.

The package also includes:

- Two back-to-school sales tax holidays lasting 14 days each ($161 million)

- Two disaster preparedness sales tax holidays lasting 14 days each ($144 million)

- A freedom summer sales tax holiday on recreational items and children’s toys that will last from Memorial Day all the way until Labor Day. ($230 million)

"In Florida, we are ensuring that our state’s economic success gets passed on to the people that made it possible," DeSantis said in a statement. "I will continue to push smart fiscal policy that will allow Florida families to keep more of their hard-earned money in their pockets.

"Stronger families make a stronger Florida.”

The permanent sales tax exemptions part of the tax relief package will save families in the state nearly $234 million, the governor's office said.

Covering items like baby and toddler needs like cribs, playpens, strollers, child safety products, diapers, baby wipes, bottles, and clothing and shoes for children under age 5 have been the main target of DeSantis' administration.

Oral hygiene products like toothbrushes/toothpaste and firearm safety devices will also be permanently exempt from sales tax.

Sales tax holidays included in the tax relief package for the 2023–2024 fiscal year include:

- Back-to-School sales tax holidays will take place July 24 – Aug. 6, 2023, and Jan. 1-14, 2024.

- Disaster Preparedness sales tax holidays will take place May 27 – June 9, 2023, and Aug. 26 – Sept. 8, 2023.

- The Freedom Summer sales tax holiday lasts from Memorial Day through Labor Day of this year.

- The Tools and Equipment sales tax holiday will take place from Sept. 2 – Sept. 8, 2023.

The package includes a one-year sales tax exemption on gas stoves and Energy Star appliances along with a reduction in the tax rate on business rent from the current 5.5% down to 4.5%. This will be effective on Dec. 31, 2023, to help small businesses keep more of their profits, DeSantis' office explains.

The tax relief package adds to the savings DeSantis already enacted earlier this year when he signed a toll relief program into law, which began in January.

"The program provides frequent commuters with 35 or more toll transactions per month with a 50% credit to their account," leaders from the governor's office explained in the release. "This program is expected to save the average commuter nearly $480 over the year and save Florida families a total of $500 million."

This legislation will also provide more than $854 million in tax incentives and sales tax refunds on building materials to help families access more housing in the communities they work in, DeSantis' office explains. This is in addition to legislation, the Live Local Act, already signed earlier in 2023.