FLORIDA, USA — Editor's Note: The video in the player above is from when FEMA announced changes were coming to its National Flood Insurance Program.

If you're already not too happy with how much your homeowner's insurance costs, then this might not be the most welcome news.

According to real estate and insurance experts, insurance costs are increasing due to things like inflation, flooding and natural disasters.

Earlier this year, FEMA announced it was updating the National Flood Insurance Program's (NFIP) risk rating methodology to leverage "industry best practices and cutting-edge technology."

Risk Rating 2.0's job is to "deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk," according to FEMA.

All remaining policies that renew on or after April 1, 2022, will be subject to the new rating methodology.

Those living in the Sunshine State can find Florida-centric information here.

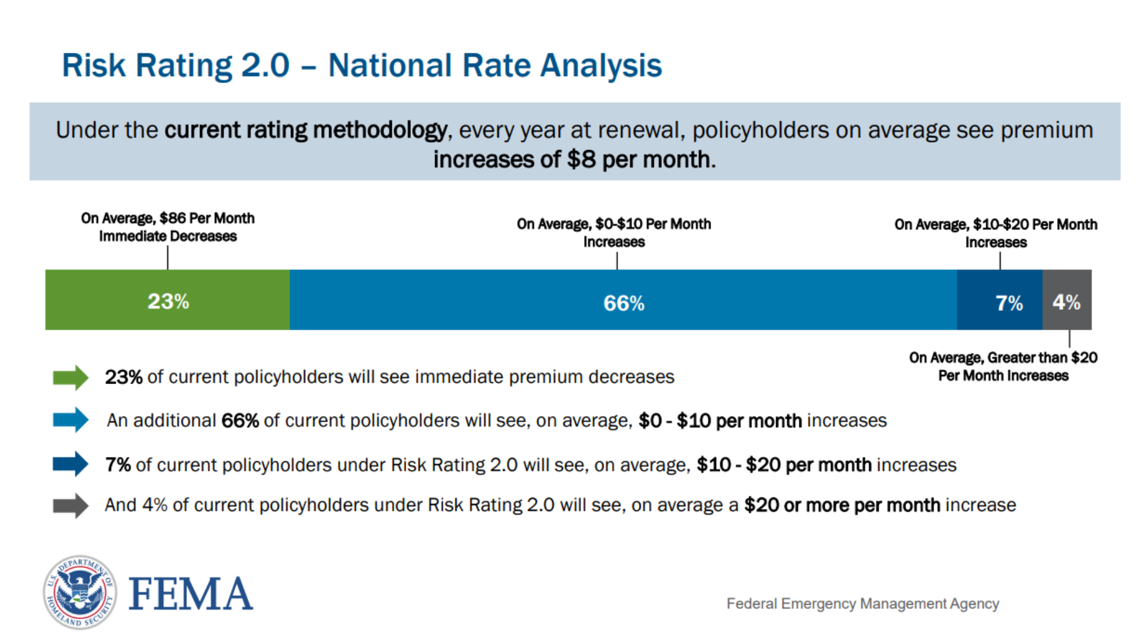

FEMA's website shows that most Americans won't see an increase of more than $10 a month on their premiums. Some, it says, could even see an immediate decrease of $86 a month.

But that's not the case for everyone.

In September, 10 Tampa Bay spoke to Chris Dailey who was building in Shore Acres. He bought the land 5 years ago, not anticipating a change in flood insurance premium policy.

"We've been very compliant in building our houses above the flood plain," said Dailey. "We did that with the expectation that we'd see the same low premiums for being out of the flood plain."

Dailey got an insurance quote in March of 2021. His paperwork shows it was for $522 a year. Now, under Risk Rating 2.0, it's $4,986.

"Well now, this FEMA Risk Rating 2.0 takes the incentive away from us and our houses - even if you're building above the flood plain - would be rated as if it was an at-grade house," said Dailey.

Brian Ford, who works at Insurances Resources, says the new methodology won't just impact people in flood zones, but the real estate market as a whole.

"A lot of these people built their houses in compliance to what FEMA had asked them to," said Ford. "And now they're going to see 18 percent increases annually until they get to the Risk Rate 2.0 actuarial rate."

SitusAMC, a real estate finance solutions company, recently reported seeing an increase in insurance costs for property owners related to the growing number of natural disasters the U.S. has seen as of late.

We're talking about things like hurricanes, tornadoes and wildfires — all of which occur in Florida.

The company, citing a USI Mid-Year Market Update, says premiums on properties outside of "catastrophe-prone zones" could see a 5-10 percent increase, while people living inside those zones could see a rise between 10-15 percent.

“We’re seeing more expensive catastrophic events across the United States this year, including 18 weather disasters with losses that each exceed $1 billion,” Mark Friedlander with Insurance Information Institute (III) told FloridaRealtors.org.

According to III, California, Florida and Louisiana saw insurance premiums spike an average of 20 to 30 percent during the past year.