TAMPA, Fla — April is financial literacy month. It comes on the heels of Gov. Ron DeSantis passing a law requiring financial literacy as a class for high schoolers next year.

It’s a topic not everyone finds interesting, but former Nickelodeon Executive Tanya Van Court hopes her app Goalsetter is a resource parents, students and even schools will use next year to turn that mindset around.

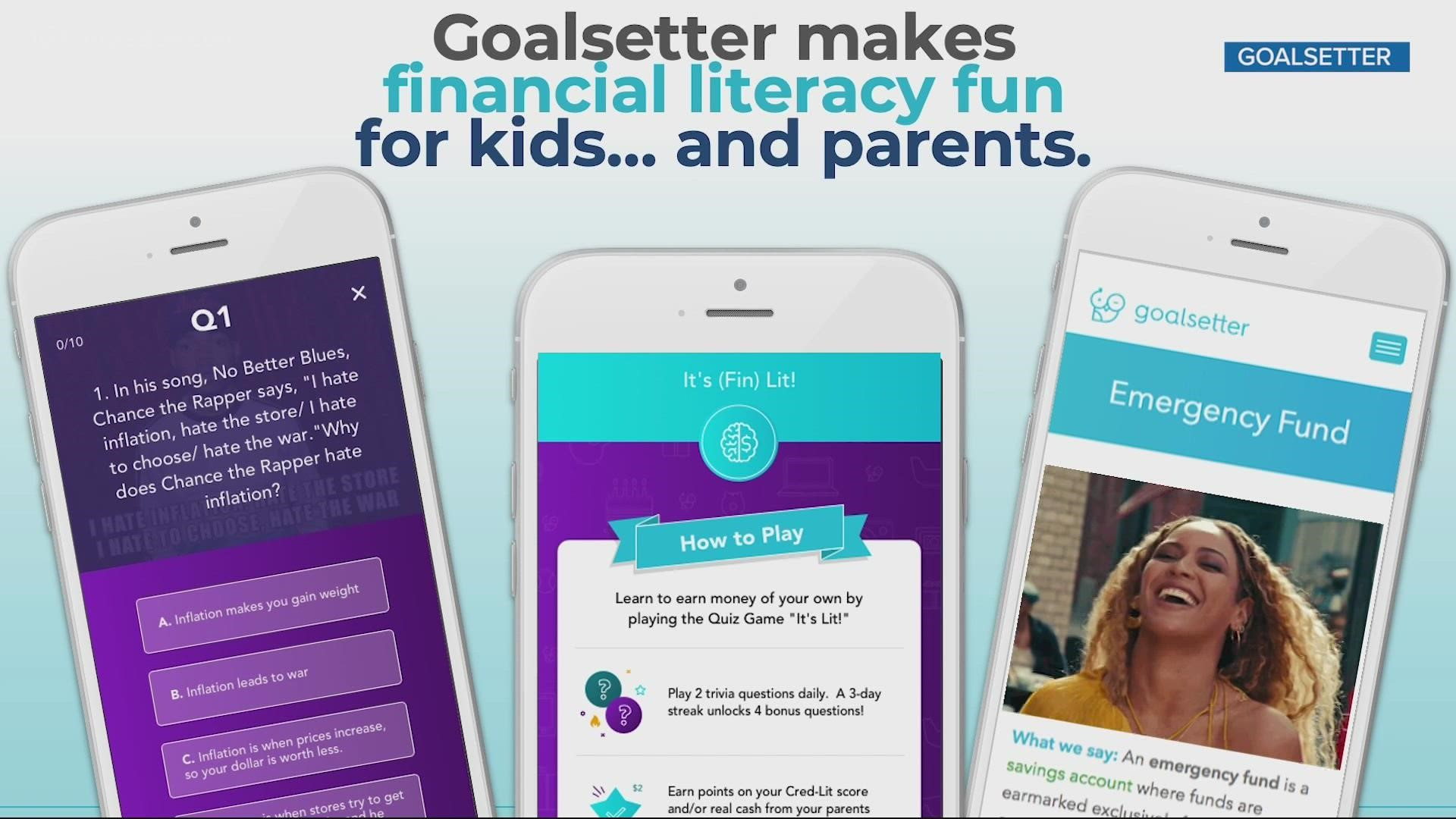

“Goalsetter is a financial education, savings, smart spending and investing platform created especially for kids and families,” Van Court explained.

Van Court knows a thing or two about teaching and keeping young people engaged. Her financial literacy app, which was featured on Shark Tank, uses celebrities, pop culture, memes and quizzes to teach kids of all ages about financial literacy in a fun, educational way.

“When Beyonce says, ‘Can you pay my bills, can you pay my telephone bills,’ We use that to explain Beyonce wouldn’t need anyone to pay her bills if she just save for an emergency fund of three to six months of her expenses. Beyonce would have enough to pay for her own bills,” she said.

It’s a unique way of teaching users not only the importance of saving but investing.

“Kids get really excited that Jay-Z is a billionaire,” Van Court explained. “When we talk about that we use his lyric that says, 'I’m not a businessman, I’m a business, man.' We explain to kids that a businessman goes and works for someone else. Jay-Z is the business because he owns the business.

"We have evidence that it’s not only something that kids want to do. It’s something that’s changing their outcomes and understanding of key financial terms."

Students are learning about the importance of frugality, compound interest and the rule of 72.

“The rule of 72 tells you how long it takes for your money to double when investing your money at a particular interest rate," the former Nickelodeon executive explained. "All you have to do is take 72, divide it by the interest rate that your money is yielding on an annual basis, and that’s how long it will take for your money to double.”

Van Court gave this example: If you put your money in a savings account at a one percent interest rate, it’s going to take 72 divided by one or 72 years to double. If you put your money into the stock market at a seven percent annual return, which is what has yielded over the past 30 years, then it takes 72 divided by seven equals, 10 years to double.

Florida is one of 11 states requiring financial literacy in high school next year, and Van Court has teamed with school districts to use the app as a learning tool.

In a world where everything is going digital, one of her goals is to simplify a complicated subject, showing students and people of all ages how easy it can be to build wealth.

“We test kids and give them a quiz that says what percentage of Jay-Z's wealth actually came from rapping. The answer is 20 percent," she said. "The reason that answer is so profound is that 80 percent of his wealth came from investing, owning his own businesses and doing all the things we’re teaching kids to do in creating their own wealth one day."

Florida school districts haven’t said they’ll be using this app as part of next year’s curriculum. but several big corporations like Nike, Delta and Lyft and others have partnered with the app offering stock options for people who use the app.